AI-Powered Portfolio Management: Balancing Efficiency and Privacy in Investment Strategies

Q: What is AI for portfolio management, and why has it gained attention?

AI for portfolio management refers to the integration of artificial intelligence techniques to assist investors and portfolio managers in various aspects of managing investment portfolios. It has gained significant attention due to its potential to revolutionize investment strategies, improve efficiency, and enhance decision-making processes.

Q: How can AI be applied in portfolio management?

AI can be applied in portfolio management in several ways:

A: Fundamental Analysis: AI can conduct textual analysis of annual reports and economic reports to extract insights and generate recommendations based on data.

A: Risk Management: AI can identify and mitigate different types of risks, such as operational, technology, liquidity, credit, and market risks. It can also analyze historical trade patterns to highlight outperforming strategies.

A: Portfolio Optimization: AI can optimize market entry and exit timings to increase returns and minimize losses, using complex algorithms like genetic algorithms.

A: Trade Management: AI enables pre-programmed trading instructions, known as algorithmic or high-frequency trading, and helps in predicting market movements to avoid high-risk or low-return trading days.

Q: What are the advantages of AI in portfolio management?

The advantages of AI in portfolio management include:

A: Improved Efficiency: AI processes vast amounts of data rapidly, accelerating decision-making processes.

A: Enhanced Accuracy: AI-driven analyses provide more accurate risk assessments, market predictions, and investment recommendations.

A: Increased Scalability: AI-based systems can handle large and complex datasets, allowing portfolio managers to scale their operations effectively.

A: Superior Performance: AI optimizes portfolio compositions and trading strategies, leading to improved investment performance and higher returns.

Q: What are the challenges and risks associated with AI in portfolio management?

Some challenges and risks include:

A: Data Quality: Accurate and reliable AI-driven analyses depend on the quality of the input data. Errors or biases can lead to flawed recommendations.

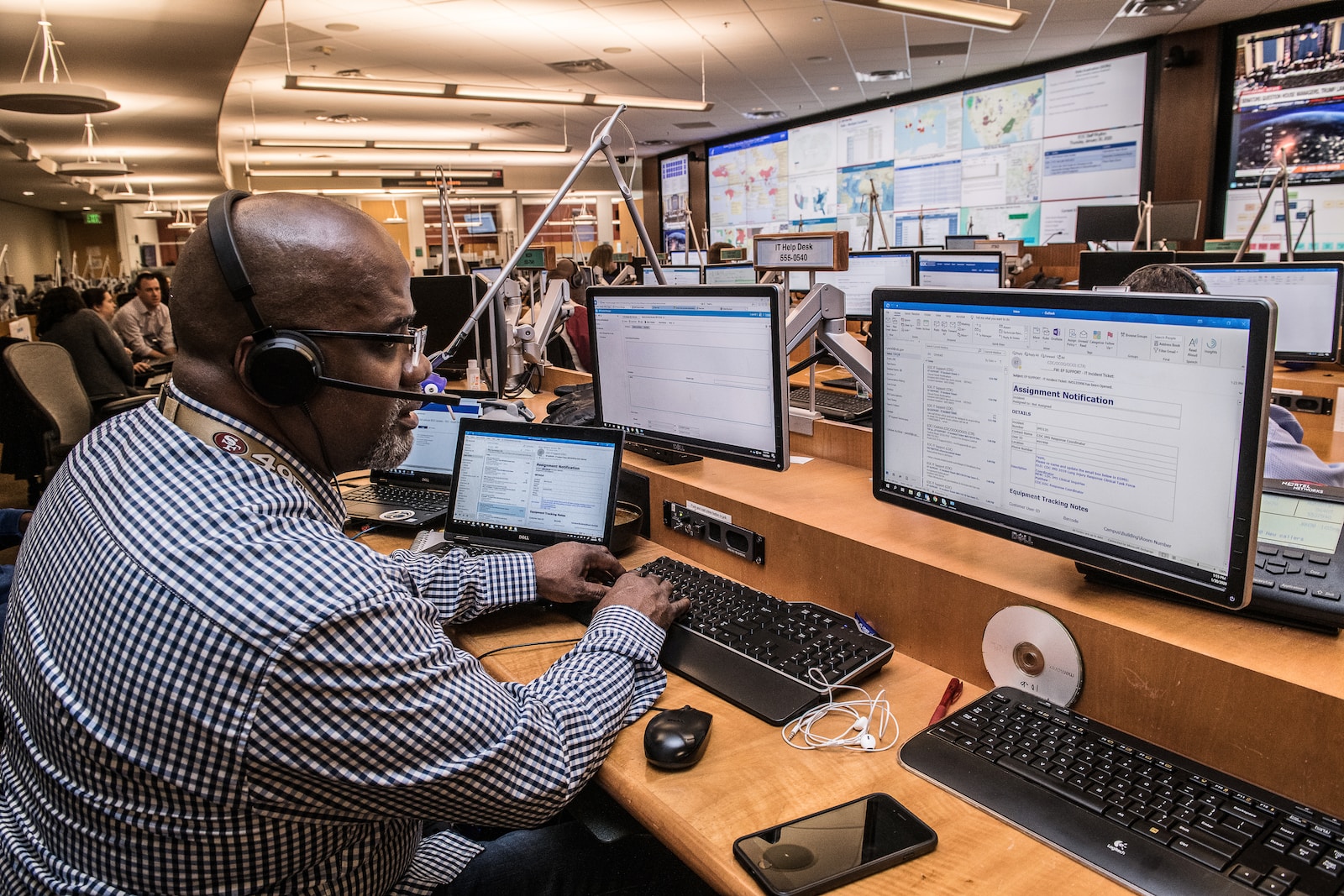

A: Security: AI systems store and process sensitive financial data, requiring robust cybersecurity measures to protect against cyber threats.

A: Transparency and Ethics: AI algorithms may operate as black boxes, making it challenging to understand their decision-making processes. Ensuring transparency and ethical use of AI are essential to build trust with investors.

A: Regulatory Compliance: AI applications in portfolio management must adhere to data privacy and financial regulations to safeguard user information and maintain industry standards.

Q: What are some AI-based portfolio management tools available in the market?

There are several AI-based tools available, each offering unique features and benefits:

A: Jarvis Invest: An AI-based investment and stock advisor in India, Jarvis Invest analyzes financial parameters to provide personalized stock recommendations and portfolio rebalancing.

A: Traders’ A.I.: This AI-based equity trading model optimizes trade positions based on AI-generated moments of higher skewness to generate excess returns over the S&P 500.

A: ChatGPT: An AI-based chatbot, ChatGPT offers cryptocurrency trading advice and constructs portfolios based on pricing and risk analysis.

A: Wrike: An award-winning project portfolio management software with AI capabilities, Wrike assesses at-risk projects and optimizes portfolios while prioritizing data privacy and security.

Q: How can investors make informed choices in AI-driven portfolio management?

Investors should consider various factors before choosing an AI-based portfolio management tool:

A: Performance: Analyze historical and expected returns and risks, assessing how the tool aligns with investment goals.

A: Cost: Compare fees and charges to ensure they fit within the budget and offer value for money.

A: Features: Evaluate the tool’s functionalities to ensure they suit specific needs and preferences.

A: Support: Examine the quality and availability of customer support and consider feedback from other users.

In conclusion, AI for portfolio management offers immense promise but requires responsible use with human oversight. By addressing data privacy, security, transparency, and ethical concerns, investors can harness AI’s power to optimize their investment strategies and enhance portfolio performance.